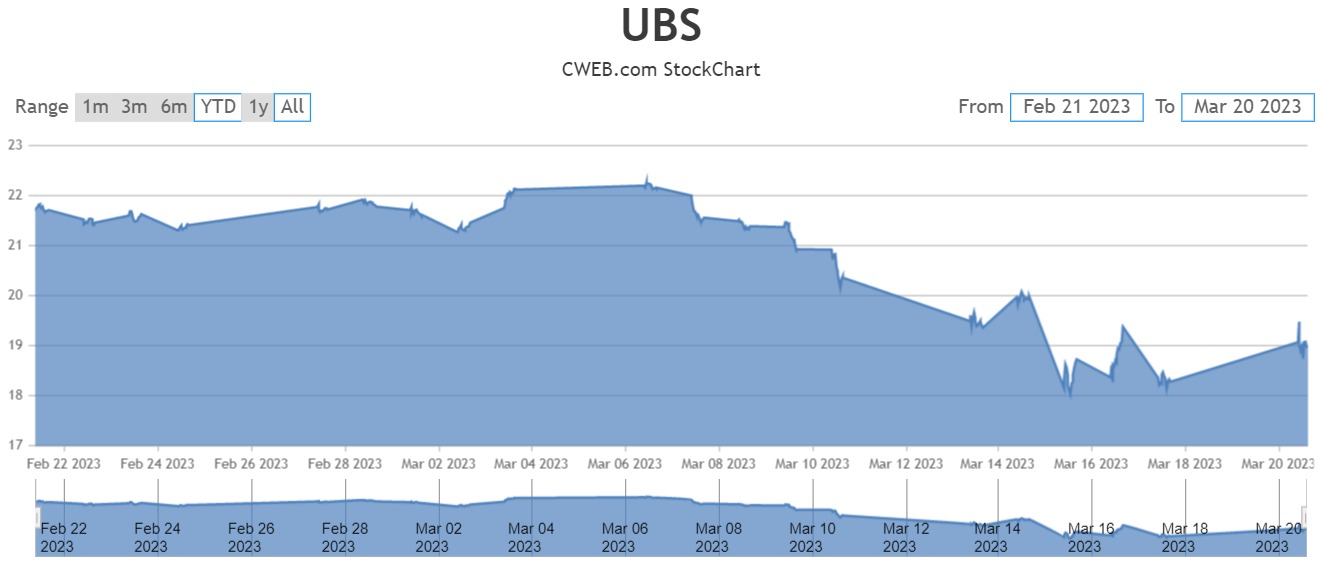

After the failure of two US banks, Credit Suisse has experienced its worst drop in the past week. Even though Credit Suisse has had difficulties in the past, they seem to be getting worse and the bank desperately needs a savior. According to reports, rival bank UBS AG (UBS) made an offer of more than two billion, and the Swiss government helped push the transaction through. The bank operates internationally, so a choice had to be made immediately given the severe confidence problem Credit Suisse is currently experiencing.

It would be an all-share deal, according to people with knowledge of the situation who wished not to be named because the deal had not been made public. At Friday’s closing price, Credit Suisse was worth approximately $8 billion or 7.4 billion francs. The transaction will ultimately cost more than $2 billion because competing bank UBS AG will only pay a small portion of the asking price.

The Financial Times, which was the first to report the deal said UBS will get a $100 billion liquidity line from the Swiss National Bank, as part of the deal. The FT also reported that the country’s authorities would change Swiss laws to bypass a shareholder vote, so that an agreement could be reached.

The Swiss central bank provided a liquidity backstop mid-week. However, the crisis continued through the week and there were weekend talks. Earlier on Sunday UBS had offered more than a billion but Credit Suisse pushed back against the offer and the buyout was reportedly increased to more than two billion.

Credit Suisse, a 167-year-old bank, survived the 2008 financial crisis but faced many challenges in the past few years including blowups and scandals. Leadership changes and legal issues also added to the turmoil. When news of its financial health spread, clients withdrew over $100 billion of assets in ninety days. Outflows also continued despite a recent 4-billion-franc capital raise.

U.S. authorities and international counterparts including Britain have worked with Swiss counterparts to broker the deal. The deal is of significant importance as Credit Suisse has global operations. The impact of the deal will be seen when markets open on Monday.

According to a report in Reuters, the Swiss central bank said, “With the takeover of Credit Suisse by UBS, a solution has been found to secure financial stability and protect the Swiss economy in this exceptional situation.”

CWEB has provided some information for this story.

Celebrity News Update– Premier Jewelry designer and manufacturer fashion house ParisJewelry.com has started manufacturing a new custom line of celebrity jewelry designs with 30% Off and Free Shipping. Replenish Your Body- Refilter Your Health with OrganicGreek.com Vitamin Bottles, Vitamins and Herbs. Become a WebFans Creator and Influencer.