As its credit rating was lowered for the second time in the same week on Monday, First Republic’s shares started the day with a sharp decline. Depositors withdrew tens of billions of dollars because they were concerned about the security and liquidity of their funds, which caused S&P Global to lower the bank’s rating.

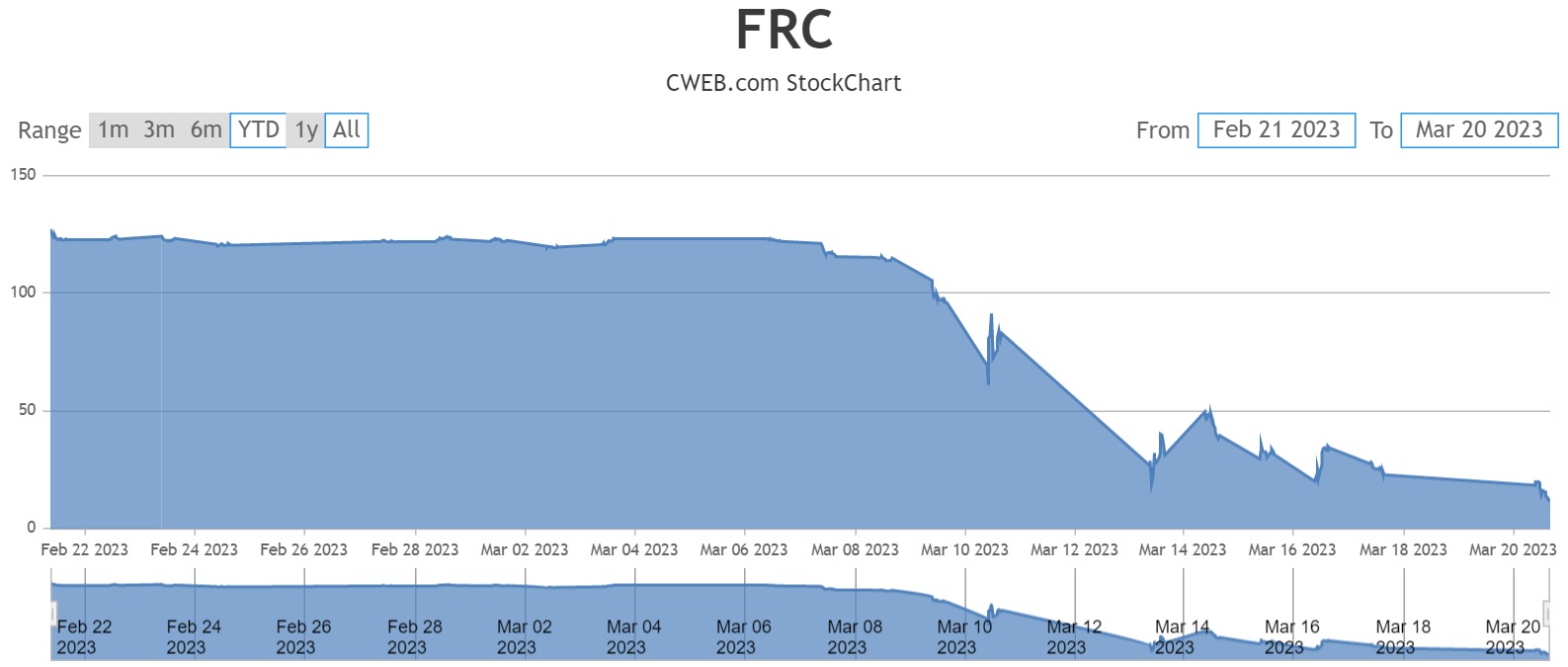

In March, the First Republic experienced a decline of more than 80%. The stock was down 41% on Monday. The stock’s instability caused numerous trading halts well into the afternoon. The day’s lowest points were close to 50%.

Bonds from the First Republic were also affected, and the price of 2046-dated bonds fell by 11%. They were exchanged for about 55 cents on the dollar. These notes were selling for more than 75 cents on the dollar in early March.

S&P Global lowered First Republic’s bond rating to B plus on Sunday. In the previous reduction, which was at BB plus, this was the second cut in a week. The rate reduction occurred as customers kept withdrawing cash, and the rating agency thought that the $30 billion lifeline provided by major US banks would only “ease near-term liquidity.”

S&P Global also said that the lifeline “may not solve the substantial business, liquidity, funding and profitability challenges” that they believed that the bank was “now likely facing,” according to a report in the Financial Times.

According to one individual who was briefed on the situation, First Republic had deposits totaling $176.4 billion at the start of the year, but has lost about $70 billion as customers withdrew their funds. These numbers were also cited in an earlier Wall Street Journal report.

However, following the influx of financial assistance from 11 major US banks, the Financial Time also reported on Friday that outflows from the California-based First Republic bank have slowed.

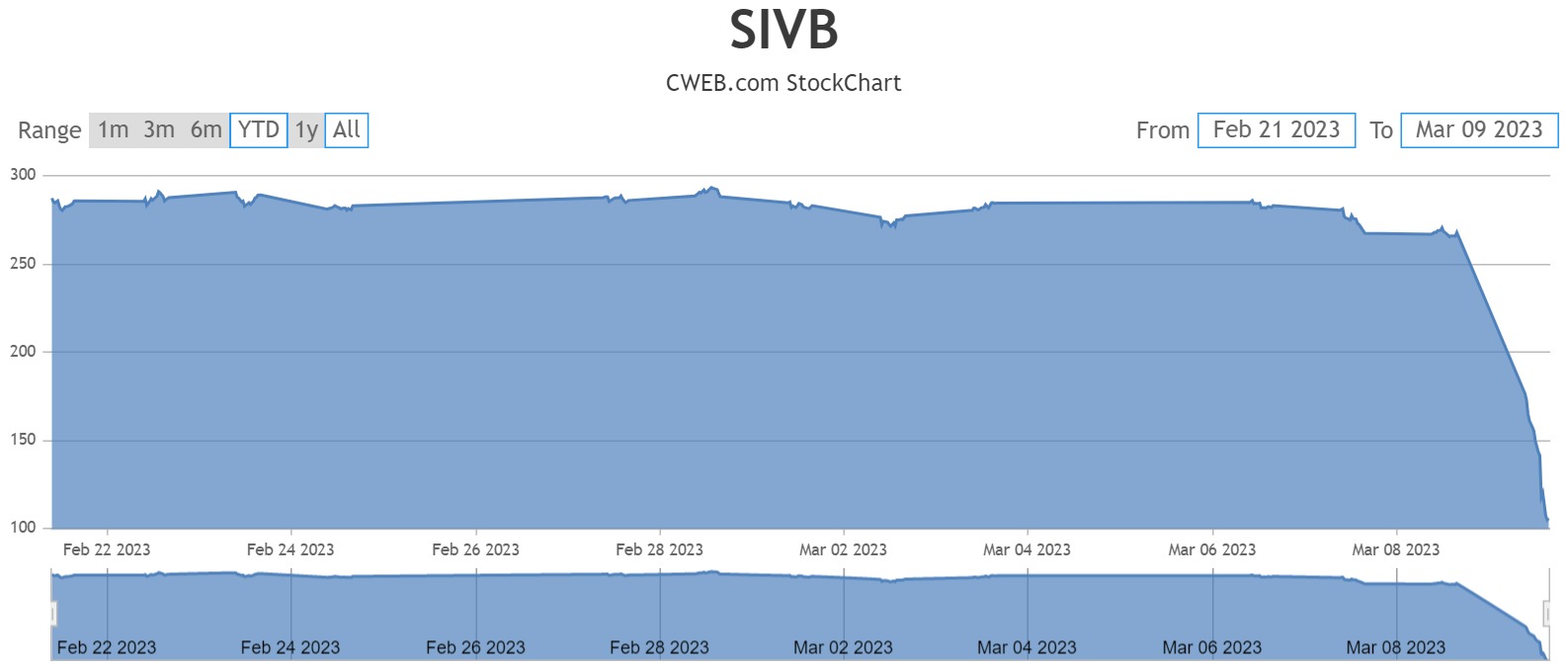

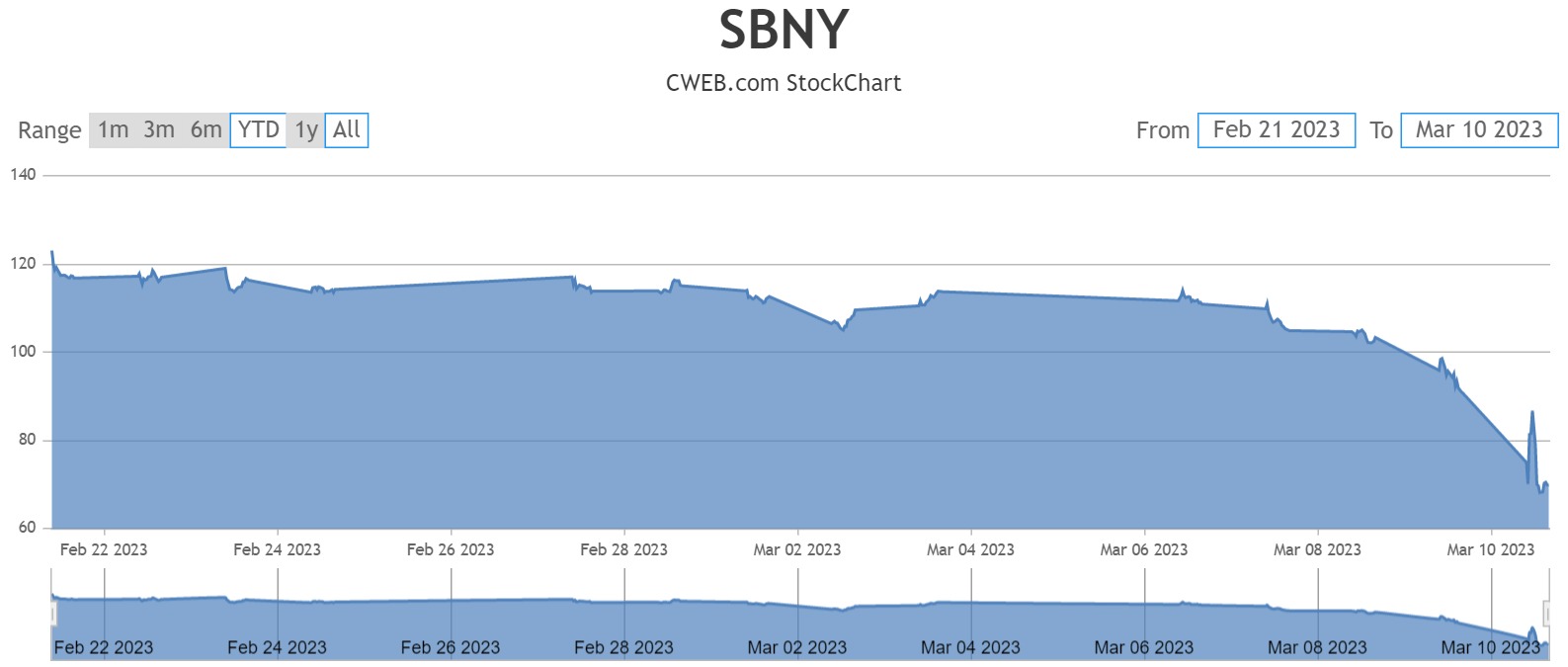

Similar patterns of withdrawal were triggered by the losses suffered by SVB and Signature Bank in other local institutions. Depositors started taking their money out and depositing it in the bigger institutions across the country.

On Monday, share values in regional banks were essentially unchanged or slightly higher, but they are still substantially below the levels prior to the problems at smaller banks like SVB and Signature Bank.

CWEB has provided some information for this story.

Celebrity News Update– Premier Jewelry designer and manufacturer fashion house ParisJewelry.com has started manufacturing a new custom line of celebrity jewelry designs with 30% Off and Free Shipping. Replenish Your Body- Refilter Your Health with OrganicGreek.com Vitamin Bottles, Vitamins and Herbs. Become a WebFans Creator and Influencer.