Earnings per Share (EPS) is estimated at $3.03 for the upcoming quarterly release.

The company’s revenue is projected to be approximately $709.5 million.

Key financial ratios such as the Price-to-Earnings (P/E) ratio of 11.74 and Current Ratio of 4.13 highlight Cal-Maine’s market valuation and liquidity.

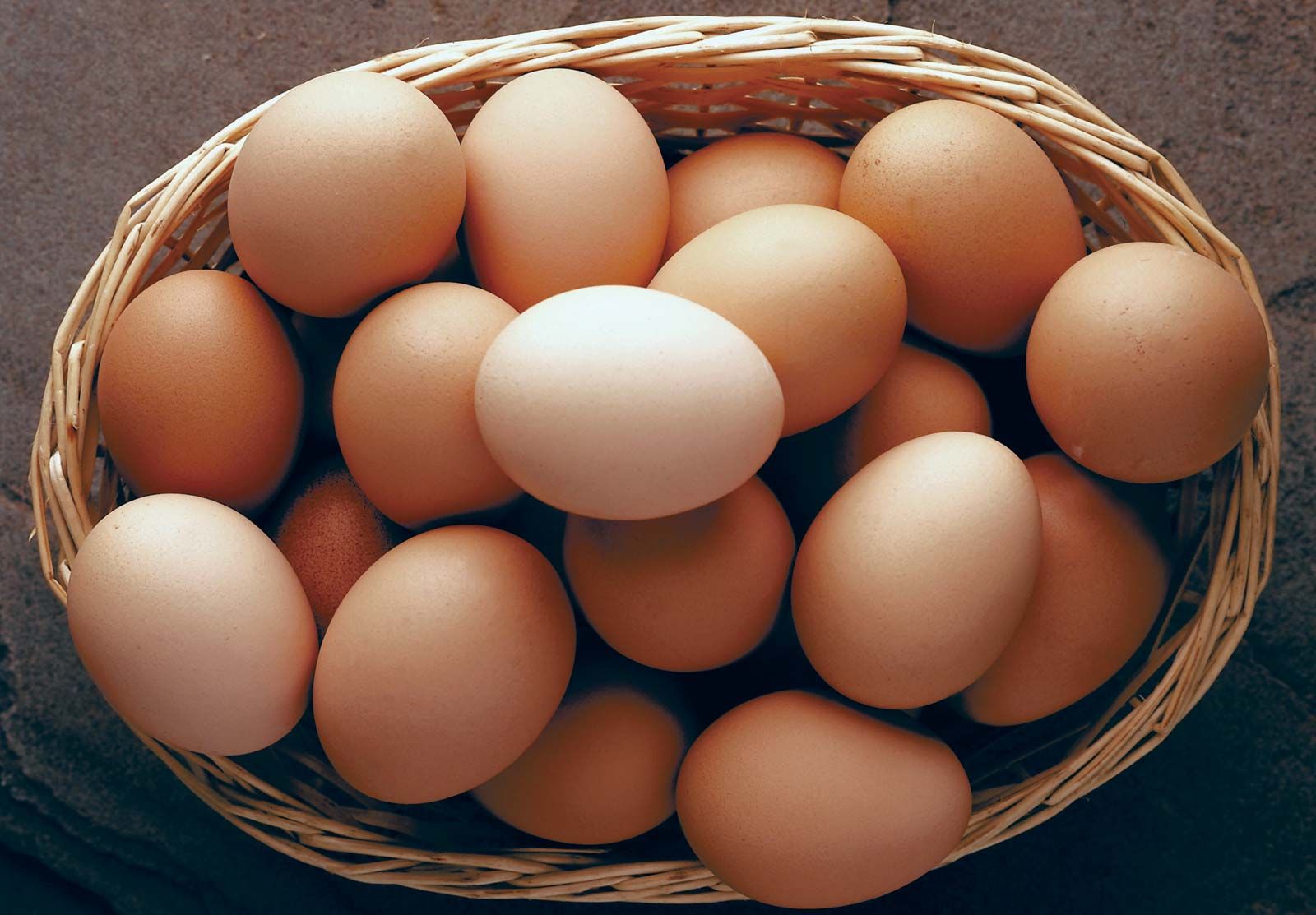

Cal-Maine Foods, Inc. (NASDAQ: CALM) is a prominent player in the egg industry, specializing in the production, grading, packaging, marketing, and distribution of fresh shell eggs. The company offers a diverse range of products, including conventional, cage-free, organic, brown, free-range, pasture-raised, and nutritionally enhanced eggs. As a leader in its field, Cal-Maine competes with other egg producers, focusing on quality and variety to maintain its market position.

Cal-Maine is set to release its quarterly earnings on Wednesday, January 1, 2025, with Wall Street analysts estimating an earnings per share (EPS) of $3.03. The company’s revenue is projected to be approximately $709.5 million. This release will provide insights into the company’s financial health and performance, as highlighted by the upcoming announcement on Tuesday, January 7, 2025, through a press release after the market closes.

The company’s financial metrics offer a deeper understanding of its market valuation. With a price-to-earnings (P/E) ratio of 11.74, investors can gauge how the market values Cal-Maine’s earnings. The price-to-sales ratio of 1.89 indicates the amount investors are willing to pay per dollar of sales, while the enterprise value to sales ratio of 1.82 reflects the company’s total valuation relative to its sales.

Cal-Maine’s enterprise value to operating cash flow ratio stands at 8.81, providing insight into its cash flow generation compared to its valuation. This ratio helps investors understand how efficiently the company generates cash from its operations. Additionally, an earnings yield of 8.52% offers a perspective on the return on investment, making it an attractive option for investors seeking returns.

The company’s current ratio of 4.13 indicates strong liquidity, showcasing its ability to cover short-term liabilities. This robust liquidity position suggests that Cal-Maine is well-prepared to meet its financial obligations, ensuring stability and confidence among investors and stakeholders.