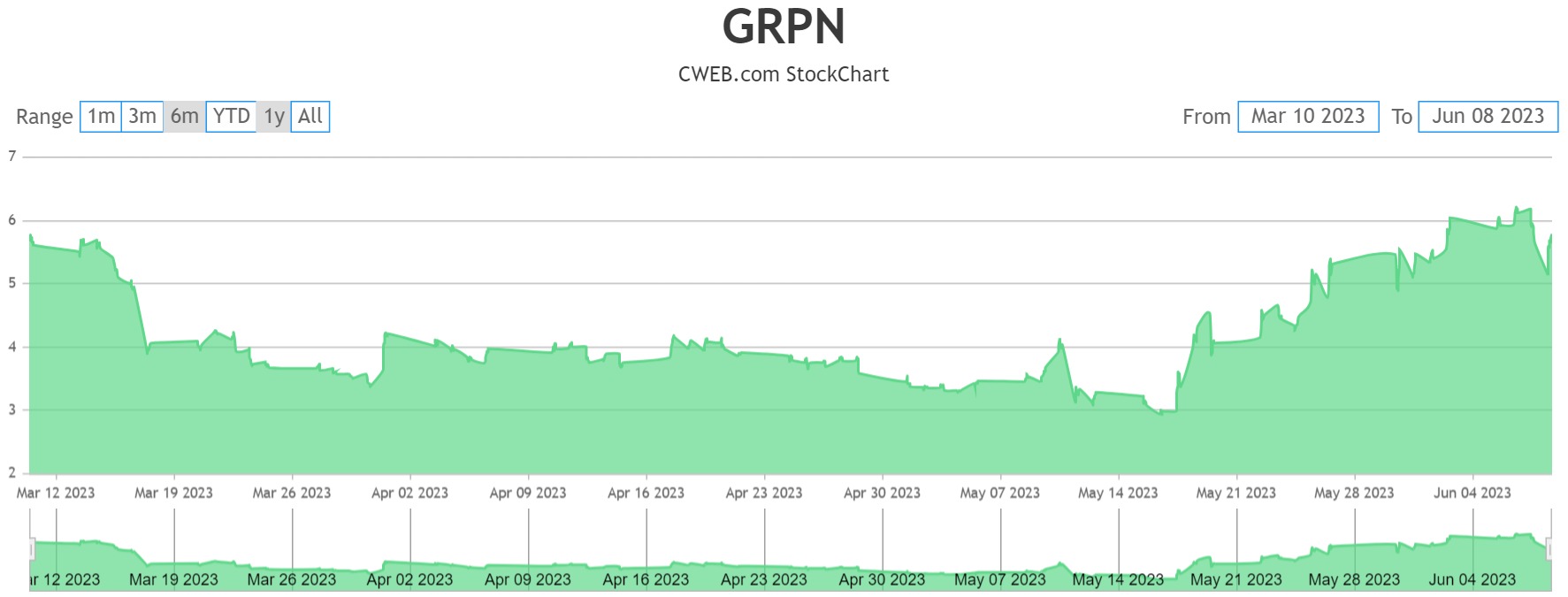

More than 73% of an investment in Groupon (NASDAQ: GRPN) has been returned to shareholders in the months of May and June. Positive trends like this bode well for the future of this e-commerce powerhouse.

Groupon expects to have saved $250 million in annualized costs by the end of 2023, as reported in its financial results for the first quarter of that year. In addition, Groupon’s leadership has unveiled its strategy to reshape the company for growth.

At the conclusion of the first quarter, Groupon had around 18.2 million active consumers, down from 22.2 million at the same time last year. There was an increase in the number of International Active Local Customers for the fifth consecutive quarter.

Groupon, Inc.’s board of directors authorized the second phase of the company’s multi-stage restructuring plan on January 25, 2023; this phase is part of the company’s larger cost-savings strategy. Groupon revealed last week that it has laid off another 500 staff in an effort to cut costs. The online retailer laid off 500 workers in August 2022, or nearly 15% of the overall staff. The corporation expects to save millions of dollars per year as a result of the layoffs, as stated in their SEC filing.

Additional non-payroll initiatives, such as reducing expenses for professional services, technology, and software, are planned to be implemented as part of the Company’s 2022 Cost Savings Plan. It is expected that these measures will result in further annualized cost savings of $30.0 million.

About 20 million people are Groupon members. More than 15 million of these people have been using the service for at least five years. The vast majority of members regularly trade goods and services with one another. Prescience Point had previously asserted that these findings proved the company to be a formidable opponent. Groupon’s core business was undervalued, as noted by market analysts.

In Q1, Groupon improved the efficiency of its marketing budget by shifting its focus from incrementality to return on investment (ROI) targets and placing a greater emphasis on lower funnel performance channels. As a result, efficiency increased, especially in terms of search engine marketing, and marketing costs as a percentage of revenue decreased. Groupon is currently focusing on maximizing profits from performance channels before redirecting its efforts to the middle and top of the sales funnel.

Thus, Groupon keeps working toward its goal of establishing a marketplace where people can buy things that enrich and enliven their lives.

The current price of Etsy shares is $90, while Target (TGT) shares are hovering around $140.Groupon is currently trading at $6.20, whereas Wish is approximately $8 in price.

By 2023’s end, Groupon should be on solid financial footing again, making it an attractive investment and opportunity for the astute investor.

Update on Celebrity News – ParisJewelry.com has begun manufacturing a new custom line of celebrity jewelry designs with 30% off and free shipping. OrganicGreek.com’s Vitamin Bottles, Vitamins, and Herbs Will Refresh Your Health. Become a Creator and Influencer on WebFans

Since the appointment of a new chief executive officer, shares of Groupon Inc. have gone up