China’s financial authorities took decisive action on Monday to stabilize its currency and markets, as investor sentiment soured over economic uncertainties and the anticipated policies of U.S. President-elect Donald Trump. With the yuan hitting its lowest point in 16 months and stock markets under pressure, the government faces mounting challenges in sustaining investor confidence.

Key Developments

Yuan Depreciation

The yuan weakened to its lowest in 16 months, sparking fears of capital outflows.

The People’s Bank of China (PBOC) may issue more yuan-denominated bills in Hong Kong to absorb liquidity and reduce speculation.

Stock Market Performance

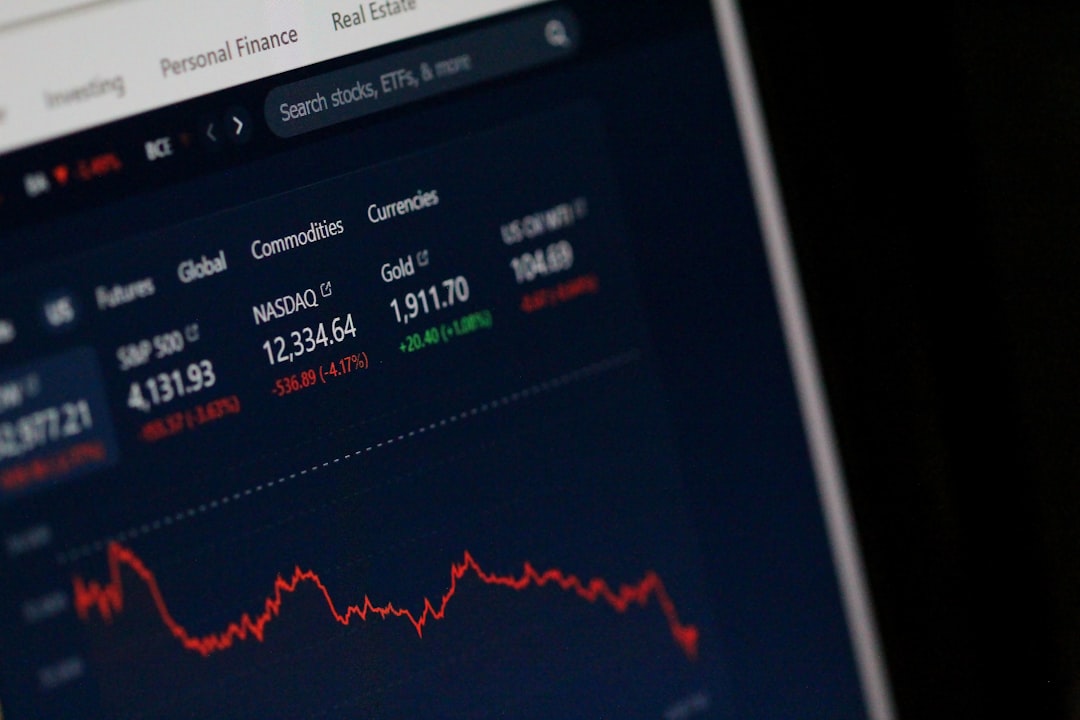

China’s blue-chip index dropped 0.8% on Monday, following a 5% weekly loss, the largest in over two years.

The Shanghai and Shenzhen exchanges reassured foreign investors, emphasizing continued market opening.

Investor Concerns

Uncertainty stems from potential tariffs on Chinese imports under the Trump administration.

Analysts highlight the need for broader measures beyond stimulus to restore market confidence.

Central Bank’s Response

The PBOC is signaling its readiness to counteract yuan depreciation with proactive measures, as emphasized in its Financial News publication. These actions aim to mitigate concerns about outflows and stabilize economic recovery efforts.

Investor Takeaways

Tracking currency fluctuations and their implications is crucial in this environment. Resources like the Forex Daily API and Sector Historical API provide in-depth market data, helping investors assess trends and make informed decisions.

Conclusion

China’s markets are grappling with domestic and international pressures as the yuan weakens and stock indices falter. Stabilizing the currency and addressing investor sentiment will be pivotal to restoring confidence and enabling a sustained recovery in 2025.