The all-cash deal values Iteris at approximately $335 million, offering shareholders $7.20 per share, a 68% premium.

Iteris’s AI-driven ClearMobility Platform and Almaviva’s digital innovation expertise are expected to revolutionize intelligent transportation systems.

The merger, awaiting approval from Iteris shareholders and regulatory bodies, is set to conclude in 2024, transitioning Iteris into a private entity.

Iteris, Inc. (NASDAQ:ITI), a pioneer in smart mobility infrastructure management, is set to join forces with Almaviva S.p.A., a distinguished Italian digital innovation group, through a definitive merger agreement. This all-cash deal pegs Iteris’s value at around $335 million, offering shareholders $7.20 per share, a 68% premium over its closing share price on August 8, 2024. This merger marks a significant milestone for Iteris, reflecting the high value and potential of its innovative solutions in the smart mobility sector.

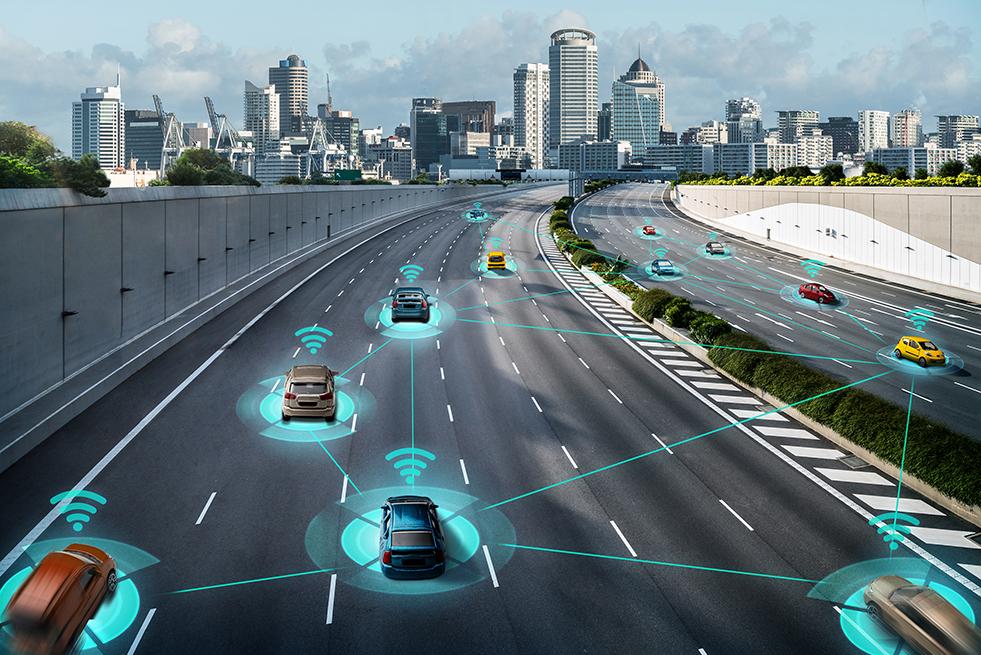

Iteris is celebrated for its AI-driven ClearMobility Platform, serving over 10,000 public and private entities globally to enhance mobility infrastructure. Almaviva, with its expertise in digital transformation and a vast network of companies and offices worldwide, complements Iteris’s mission to revolutionize intelligent transportation systems. The synergy between Iteris’s smart mobility solutions and Almaviva’s digital innovation prowess is expected to drive forward the future of digital mobility, as emphasized by Joe Bergera, President and CEO of Iteris.

The merger, slated for completion in 2024, awaits the green light from Iteris shareholders, regulatory bodies, and the fulfillment of other standard closing conditions. Almaviva’s commitment to financing the acquisition through debt, without the need for a financing condition, underscores the firm’s confidence in the merger’s success. Once finalized, Iteris will transition into a private entity, withdrawing its common stock from Nasdaq, marking the end of its public trading journey.

The advisory teams for this transaction include prestigious financial and legal advisors, ensuring a smooth merger process. Morgan Stanley & Co. LLC and Latham & Watkins LLP are guiding Iteris, while Almaviva leans on the expertise of Goldman Sachs Bank Europe SE, King & Spalding LLP, and others. This strategic merger is anticipated to bolster Iteris’s global market presence in smart mobility infrastructure management, fostering innovation and growth within Almaviva’s extensive digital innovation ecosystem.